Your Table mat gst rate images are available in this site. Table mat gst rate are a topic that is being searched for and liked by netizens today. You can Find and Download the Table mat gst rate files here. Get all free photos.

If you’re searching for table mat gst rate pictures information related to the table mat gst rate topic, you have pay a visit to the right site. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Table Mat Gst Rate. The GST Council revises the rate slab of goods and services on a periodic basis. The GST rate slabs are decided by the GST Council. Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. 100 divided by 11 909.

2 Gst Rates On Bamboo Products Download Table From researchgate.net

2 Gst Rates On Bamboo Products Download Table From researchgate.net

13 11 6 3. GST rates for all HS codes. Commonly used Goods and Services at 5 Standard Goods and Services fall under 1st slab at 12 Standard Goods and Services fall under 2nd Slab at 18 and Special category of Goods and Services including luxury. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price.

The GST rate slabs are decided by the GST Council.

We already know that the GST slabs are pegged at 5 12 18 28. Table kitchen or other household articles of aluminium. Four main GST rate slabs framed with Essential goods and services Standard goods and services and luxury goods and services with 5 12 18 and 28 respectively. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. You are adviced to double check rates with GST rate. A taxable sale must be.

Source: pinterest.com

Source: pinterest.com

Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. We already know that the GST slabs are pegged at 5 12 18 28. Table kitchen or other household articles of aluminium. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs.

Source: in.pinterest.com

Source: in.pinterest.com

Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance.

Source: researchgate.net

Source: researchgate.net

Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. 38 of the Table mentioned in the notification No. A taxable sale must be. Four main GST rate slabs framed with Essential goods and services Standard goods and services and luxury goods and services with 5 12 18 and 28 respectively. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate.

Source: pinterest.com

Source: pinterest.com

38 of the Table mentioned in the notification No. We already know that the GST slabs are pegged at 5 12 18 28. 100 divided by 11 909. The GST rate slabs are decided by the GST Council. If the goods specified in this entry are supplied by a supplier along with supplies of other goods and services one of which being a taxable service specified in the entry at S.

Source: in.pinterest.com

Source: in.pinterest.com

Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. The most essential goods and services attract nil rate of GST under Exempted Categories. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. Introduction 1 11 Purchases with no GST 1.

Source: researchgate.net

Source: researchgate.net

Attend our GST webinar to help you to understand GST and its implications for business. The GST amount on the product is 909. They are 5 GST 12 GST 18 GST 28 GST. 13 11 6 3. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description.

Source: researchgate.net

Source: researchgate.net

Barbers chairs and similar chairs having rotating as well as both reclining and elevating mo Hs Code. 38 of the Table mentioned in the notification No. Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. 13 11 6 3. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia.

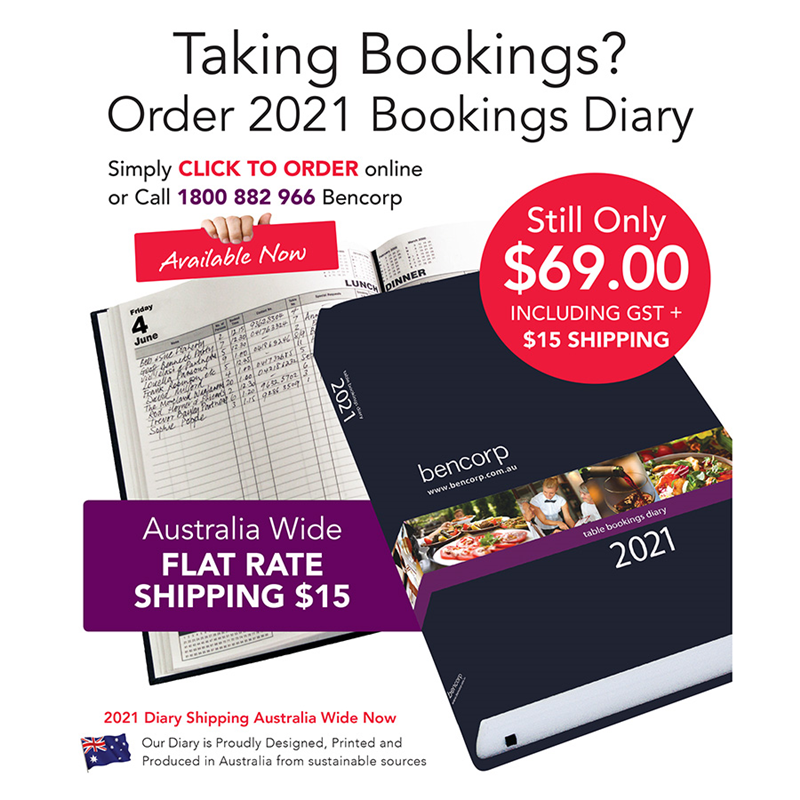

Source: bencorp.com.au

Source: bencorp.com.au

38 of the Table mentioned in the notification No. Attend our GST webinar to help you to understand GST and its implications for business. The GST Council revises the rate slab of goods and services on a periodic basis. GST rates for all HS codes. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price.

Source: in.pinterest.com

Source: in.pinterest.com

Explains how goods and services tax GST works and what you need to do to meet your GST obligations. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs. 57021000 Kelem Schumacks Karamanie and similar hand-woven rugs. You divide a GST inclusive cost by 11 to work out the GST component.

Source: br.pinterest.com

Source: br.pinterest.com

The GST rates are usually high for luxury supplies and low for essential needs. Province On or after October 1 2016 July 1 2016 to September 30 2016 April 1 2013 to June 30 2016 July 1 2010 to March 31 2013 January 1 2008 to June 30 2010. In India GST rate for various goods and services is divided in four slabs. 690E the value of supply of goods for the purposes of this entry shall be deemed as. 909 multiplied by 10 GST rate of 10 9091.

Source: howtoexportimport.com

Source: howtoexportimport.com

13 11 6 3. A taxable sale must be. You are adviced to double check rates with GST rate. 100 divided by 11 909. You divide a GST inclusive cost by 11 to work out the GST component.

Source: in.pinterest.com

Source: in.pinterest.com

Capital gains tax 28000 42 100 11760 Goods and services tax The goods and services tax GST is a tax of 10 which is added to the price of most goods including cars and services such as insurance. Example 3 Calculating GST a If the cost of electricity supplied in one quarter is 28850 how much GST will be added to the bill. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price. Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron. 38 of the Table mentioned in the notification No.

Source: nypartyhire.com.au

Source: nypartyhire.com.au

Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. 5702 CARPETS AND OTHER TEXTILE FLOOR COVERINGS WOVEN NOT TUFTED OR FLOCKED WHETHER OR NOT MADE UP INCLUDING KELEM SCHUMACKS KARAMANIE AND SIMILAR HAND-WOVEN RUGS Hs Code Item Description. Table kitchen or other household articles of aluminium. The most essential goods and services attract nil rate of GST under Exempted Categories. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate.

Source: swiftsupplies.com.au

Source: swiftsupplies.com.au

Established in the year 1987 at New Delhi India we Kapoor Plastic Agencies are Sole Proprietorship based firm involved in the manufacturing of Table Sheet Table Cover Bed Sheet Kitchen Roll Table Mat and PVC ClothAlong with this our reliability in business practices timely completion of the undertaken consignment orders and reasonable prices have enabled us gaining the trust of. 5702 CARPETS AND OTHER TEXTILE FLOOR COVERINGS WOVEN NOT TUFTED OR FLOCKED WHETHER OR NOT MADE UP INCLUDING KELEM SCHUMACKS KARAMANIE AND SIMILAR HAND-WOVEN RUGS Hs Code Item Description. They are 5 GST 12 GST 18 GST 28 GST. Example 3 Calculating GST a If the cost of electricity supplied in one quarter is 28850 how much GST will be added to the bill. 9402 Medical surgical dental or veterinary furniture for example operating tables examination tables hospital beds with mechanical fittings dentists chairs.

Source: in.pinterest.com

Source: in.pinterest.com

Pot Scourers And Scouring Or Polishing Pads Gloves And The Like Of Iron Or Steel Description. Table kitchen or other household articles of aluminium. Iron Or Steel Wool. 112017-Central Tax Rate dated 28th June 2017 GSR. Table of Contents Page 1.

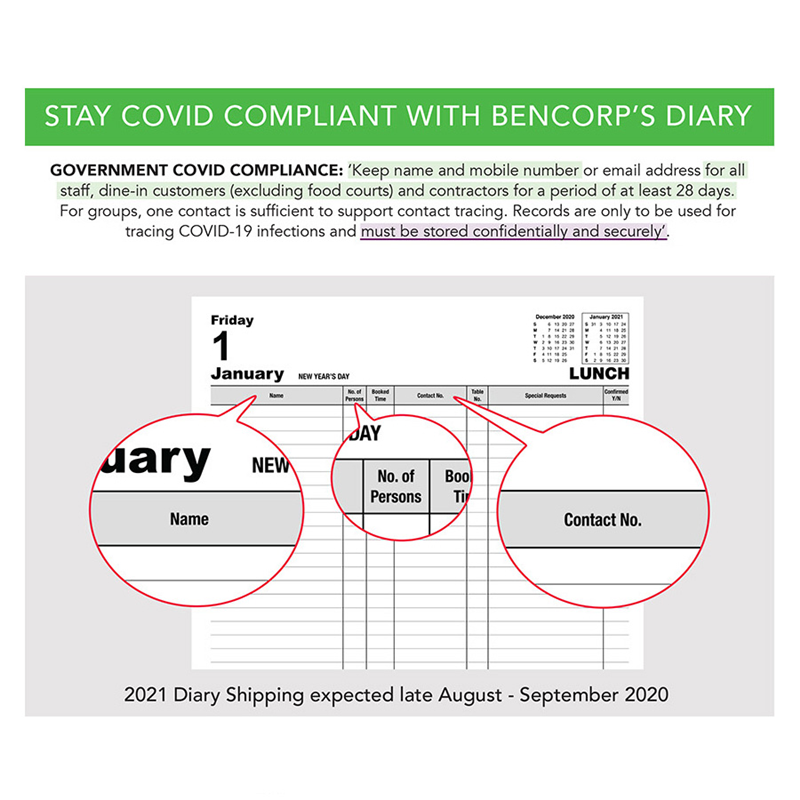

Source: bencorp.com.au

Source: bencorp.com.au

13 11 6 3. The GST rate slabs are decided by the GST Council. They are 5 GST 12 GST 18 GST 28 GST. Under GST- 5 percent for essential goods standard rate of 12 and 18 percent high rate of 28 percent and peak rate of 28 percent plus cess for luxury items. 5702 CARPETS AND OTHER TEXTILE FLOOR COVERINGS WOVEN NOT TUFTED OR FLOCKED WHETHER OR NOT MADE UP INCLUDING KELEM SCHUMACKS KARAMANIE AND SIMILAR HAND-WOVEN RUGS Hs Code Item Description.

Source: researchgate.net

Source: researchgate.net

Attend our GST webinar to help you to understand GST and its implications for business. Table of Contents Page 1. Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. Province On or after October 1 2016 July 1 2016 to September 30 2016 April 1 2013 to June 30 2016 July 1 2010 to March 31 2013 January 1 2008 to June 30 2010. This calculator can help when youre making taxable sales only that is a sale that has 10 per cent GST in the price.

Source: tr.pinterest.com

Source: tr.pinterest.com

In India GST rate for various goods and services is divided in four slabs. 112017-Central Tax Rate dated 28th June 2017 GSR. Supplies subject to GST at the rate of 10 - are made if a supply is for consideration made in the course of continuing an enterprise connected with Australia and the supply is neither GST-free or input taxed. Iron Or Steel Wool. Table Kitchen Or Other Household Articles And Parts Thereof Of Iron Or Steel.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title table mat gst rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.